At Alternatives...

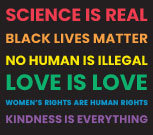

We recognize the present social injustices and racism that exist within our nation. We embrace the rich perspectives and experiences that arise from racial, ethnic, socio-economic, sexual, gender and religious diversity in our community. Our purpose is to find solutions for those who have been held back unjustly by economic inequality. Whatever your current financial situation is we're glad you’re here!